Savings Builder Account

Reach your financial goals faster with no monthly maintenance fee. Plus, we’ll reward you with an extra $5 for every month you grow your balance by $200 or more for the first year. footnote 1

- $0

Monthly maintenance fee

- $5 reward

For every month you grow your balance by $200 or more for the first year! footnote 1

- $25

Minimum opening deposit

Get a full breakdown of the account fees, terms and agreements

Check out our Savings Builder rates footnote 5

Minimum Balance

$0.01 and above

Interest Rate

X.X%Annual Percentage Yield (APY) footnote 5

X.X%

Interested in exploring other savings accounts?

We’ve got one that meets your unique needs.

Let’s take a closer look at fees and how to avoid them

You’ll pay no monthly maintenance fee and there’s no minimum monthly balance. But there are some less-common fees we want you to know about.

| Feature | Fee |

|---|---|

| Monthly maintenance fee | $0 |

| BMO and Allpoint® ATM transactions in the U.S. | FREE |

| Non-BMO ATM Transaction fee footnote 7 | $3 |

| Paper statements | $3 (you can go paperless for free statements footnote 8) |

| Minimum opening deposit | $25 |

Savings BuilderFrequently Asked Questions

Opening a new account online is quick and easy. All you need is:

- Your phone number, email address and U.S. residential address

- Your date of birth and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- U.S. citizenship or status as U.S. Resident Alien

- If neither applies to you, don't worry - you can still apply for an account by visiting a branch or calling us at 1-888-340-2265

- Information to help you deposit money from your other bank, including one of the following:

- The other bank's login credentials

- Their routing and account numbers

If you’re opening an account online, it takes less than 5 minutes to complete the application and open your account.

If you prefer to open an account in a branch, it shouldn’t take longer than 15 minutes.

Don’t worry, you can save at your own pace – there’s no minimum monthly deposit required for this account.

We’ll give you an extra $5 every month that you’re able to grow your balance by $200 or more for the first year, footnote 1 but that’s completely optional.

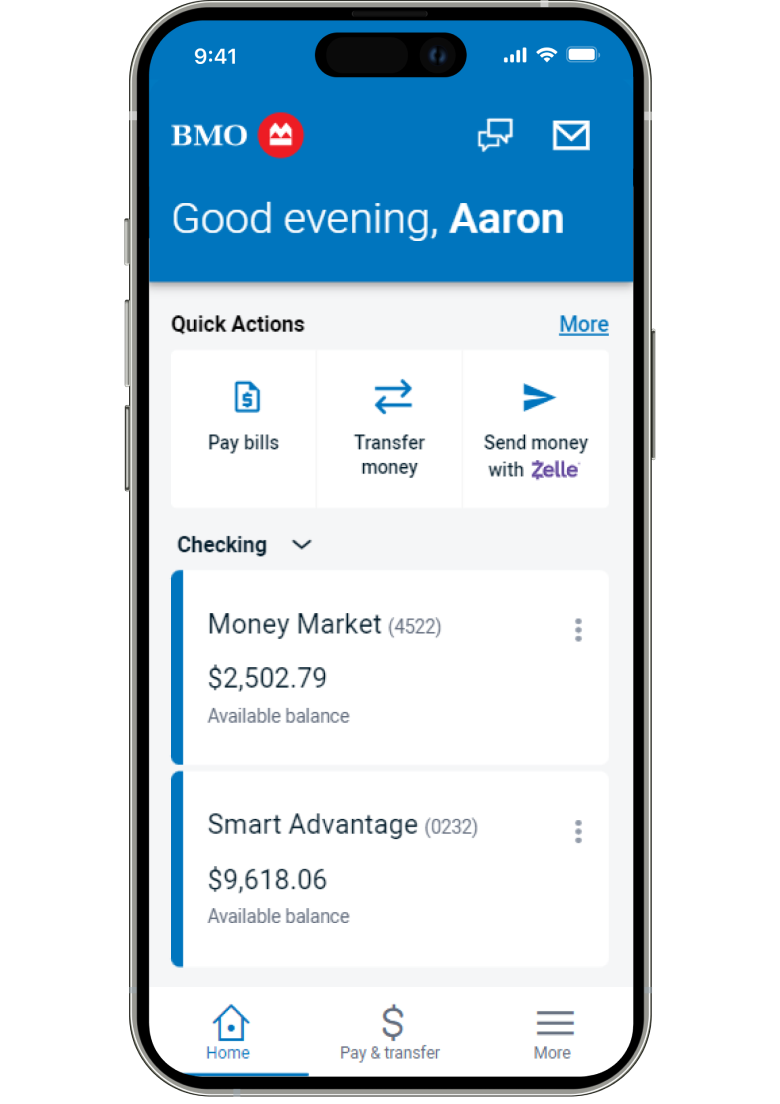

We make banking easy

Manage all your banking needs, whenever and wherever you like. Bank from anywhere with our simple online and mobile tools or find a no-fee footnote 7 ATM close to you.

Set and track a financial goal with our Saving Goal tool

With Savings Goals, you can set a personalized financial goal and monitor your savings progress every time you access your account in BMO Digital Banking.

Bank from anywhere with Mobile Deposit footnote 9

Skip the trip to the bank and deposit checks directly from your smartphone with mobile deposits.

Set up automatic transfers footnote 10 to grow your savings faster

With auto transfers from your checking account to your savings, you can grow your money without even having to think about it.

over 40,000fee-free footnote 6 ATMs across the U.S.

Enjoy unlimited fee-free transactions at over 40,000 BMO and Allpoint® ATMs nationwide.

Resources to help you reach your savings goals

Footnote 1 detailsFor every month your Savings Builder account balance grows by at least $200, we will credit the account with a $5 savings reward within 5 calendar days after the end of the month. To calculate if your balance has grown by $200, we will compare the Ledger Balance on the last Business Day of the previous month to the Ledger Balance on the last Business Day of the current month. Interest and savings reward payments will not count towards your balance growth. Tip: Deposits made on weekends and holidays will not be processed until the next Business Day. To ensure your deposit is counted for the current month, avoid scheduling your recurring transfer or deposits toward the end of the month.

Your account is eligible for 12 savings rewards beginning with the month your account is opened. The first savings reward is based on your savings growth from the Business Day the account is opened through the last Business Day of that month. If your initial deposit is not received until the month after account opening, the account will only be eligible for 11 savings rewards.

Your account must be open when the savings rewards are paid. Savings rewards will be reported to the IRS for tax purposes and you are responsible for any applicable taxes.

- Exclusions:

Savings rewards are available for new accounts only. An account switched into Savings Builder from a different product is not eligible for savings rewards.

Savings rewards are limited to one Savings Builder account per customer as the Primary Account Owner. Only your first account opened is eligible for savings rewards.

You are not eligible to receive savings rewards if you have previously opened a Statement Savings account between February 3, 2020 and October 18, 2021 and participated in the Statement Savings account – Savings Rewards offer.

Minimum opening deposit of $25 is required for BMO Savings Builder accounts. Savings Builder is a variable rate account. Interest rates and Annual Percentage Yields (APYs) may change daily after the account is open. Interest rates and APYs offered within two or more consecutive tiers may be the same. In this case, multiple tiers will be shown as a single tier. The following collected balance tiers and corresponding APYs for Savings Builder are effective as of , and are subject to change at our discretion at any time: 0.01% for all balances. Interest is calculated on the entire collected balance daily at the rate in effect for that balance tier. You must maintain the required minimum collected balance for each tier in order to earn the APYs disclosed. A periodic rate is applied on the collected balance in the account daily. Interest is compounded daily on the collected balance and credited to the account monthly on the statement period date. Checks you deposit into your account begin to earn interest on the Business Day we receive credit for them. Fees and withdrawals may reduce earnings. For account and fee information or current interest rates, visit bmo.com.

Footnote 2 detailsVisit the BMO Security Center for details.

Footnote 3 detailsMessage and data rates may apply. Contact your wireless carrier for details.

Footnote 4 detailsPlease visit www.fdic.gov for current deposit insurance limits.

Footnote 5 detailsAll Interest Rates and Annual Percentage Yields (APY) are accurate as of the effective date shown above. For variable rate accounts, interest rates and APYs may change after the account is opened. At our discretion we may change the interest rate on these accounts daily. For accounts that have more than one tier, the interest rate corresponding to the highest tier into which the collected balance falls will be paid on the entire collected balance. Fees or withdrawals will reduce earnings. These rates apply to our Illinois and Northwest Indiana locations, excluding locations in South Beloit, Roscoe and St. Clair County in Illinois.

Footnote 6 detailsForeign Transaction Fees will apply at Allpoint® ATMs located outside of the United States.

Footnote 7 detailsA Non-BMO ATM Transaction is any transaction conducted at a Non-BMO ATM, including, for example, a withdrawal, transfer, or balance inquiry. We charge this fee for each Non-BMO ATM Transaction, except for a balance inquiry. The ATM owner or operator may also charge you a surcharge fee for a withdrawal, transfer, or balance inquiry.

Footnote 8 detailsThe monthly fee for paper statements is automatically waived if you opt to go paperless through your BMO Digital Banking preferences or if any individual associated with your account is 65 years or older.

Footnote 9 detailsMobile Deposit is available using the BMO Digital Banking App. This service may not function on older devices. Users must be a BMO Digital Banking customer with a BMO account opened for more than 5 calendar days. Deposits are not immediately available for withdrawal. For details, please see the BMO Digital Banking Agreement found at bmo.com/en-us/legal.

Footnote 10 detailsIf you make an Internal Transfer on a weekend or holiday, we’ll credit the payment the same day, but we’ll post the payment on the next Business Day.