Welcome offer

Minimum $80,000 (individual) or $150,000 (household) annual income required.

Get the $120 annual fee rebated annually with our BMO Premium Chequing Account.††

Plus, get 1% cash back on all other purchases2B with no limit on how much cash back you can earn!

Ready to start earning more cash back? Here’s what you need to know.The annual fee is waived in the first year - a savings of $120.**

ERROR API VALUE NOT FOUND

annual fee8

ERROR API VALUE NOT FOUND

for purchases8

ERROR API VALUE NOT FOUND

for cash advances8

Minimum $80,000 (individual) or $150,000 (household) annual income required.

Enjoy six months of Instacart+ and a $10 monthly Instacart credit when you enroll your eligible BMO Credit Card.120 Terms apply.

Groceries (5% cash back) Footnote 2B, Footnote 75

Transit: (4% cash back) Footnote 2B, Footnote 77

Gas and electric vehicle charging (3% cash back) Footnote 2B, Footnote 78

Recurring bill payments (2% cash back) Footnote 2B, Footnote 79

All other purchases (1% cash back) Footnote 2B

Total cash back in your first year 0

Including $40 monthly cash back during your first year when you spend a minimum of $2,000 each month.**

Redeem your cash back whenever you want, or simply set up recurring deposits and get rewarded automatically.51

Your cash back rewards never expire as long as your account is open and in good standing.

No waiting! Redeem your cash back any time you want for as little as $1.

Set up automatic deposits starting at $25.

Enjoy the flexibility to put your cash back where you want:

Statement credit

BMO chequing or savings account

InvestorLine

Protect your next adventure with BMO Travel Insurance

Although your credit card does not include travel insurance, we make it easy to travel confidently with our flexible travel coverage options.

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Start earning and redeeming more cash back now.

We’ll respond in under 60 seconds.

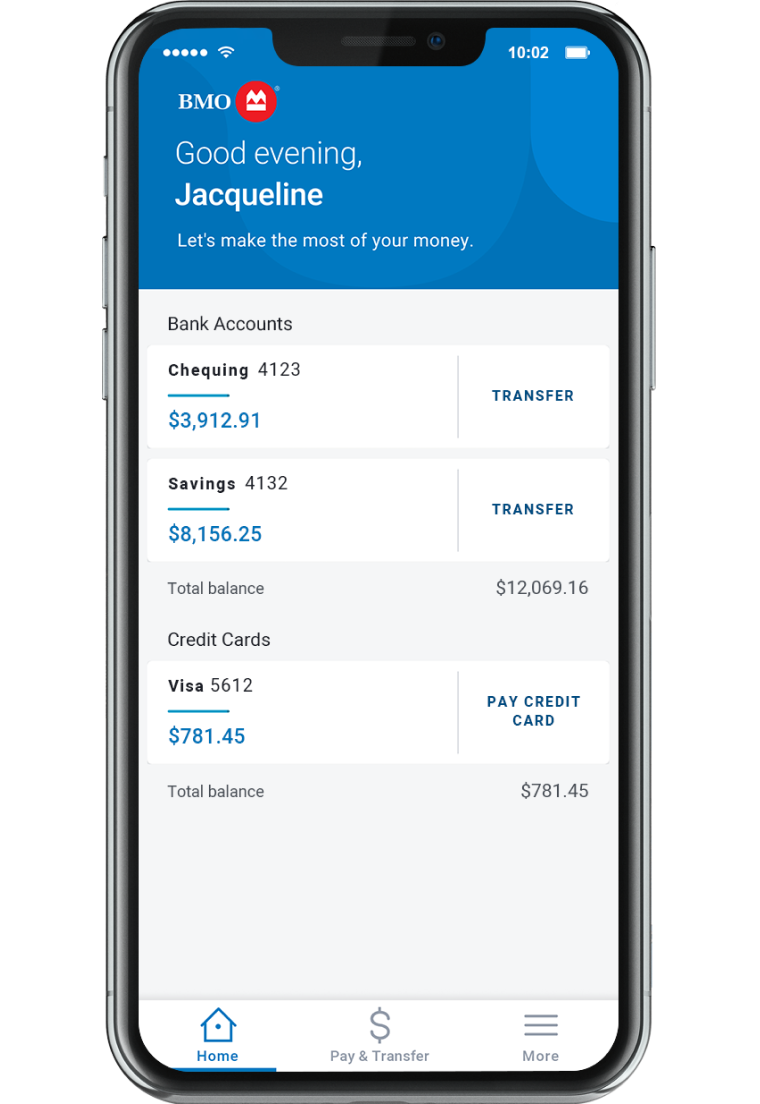

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Stay on top of your spending with a personalized look at your money.

Get free, 24/7 access to Credit Coach with no impact to your credit score.

Resolve an issue with your statement or reset your PIN directly from your mobile app.

When you make a purchase at a grocery store or supermarket that sells a complete line of food products (think vegetables, ice cream and everything in between), you can earn 5% cash back up to a limit of $500 spent for a given statement period.75

When paying for public transit, taxis, ride sharing and more, you can earn 4% cash back up to a limit of $300 spent for a given statement period.77

Whether you pay for gas in-store or at the pump at your local service station, you can earn 3% cash back up to a limit of $300 spent for a given statement period. Thinking about going green? Where available, electric vehicle charging station purchases can also be included with gas purchases to earn 3% cash back up to a limit of $300 spent for a given statement period.78

Recurring bill payments are made on a regular basis – your monthly Internet bill, for example. The merchant (or your Internet service provider) automatically bills your card each month. This sort of automatic bill payment made with your BMO CashBack® World Elite®* Mastercard®* may be eligible for 2% cash back up to a limit of $500 spent for a given statement period.

Not all merchants offer recurring payments, and not every recurring bill payment will earn the bonus cash back, so check with your providers to find out how they are processing your bill payment.79

It’s easy! There are three simple ways to see how much you’ve earned:

Log in to bmocashback.com;

or

Check your cash back balance on your monthly BMO credit card statement;

or

Check your cash back balance when you log in to BMO Online Banking or the BMO Mobile Banking app.

To help you keep tabs on your cash back activity, your Online Statement shows you how much you’ve earned, up to the billing date. Any cash back earned after the billing date will be included in your next month’s statement.

You can redeem your cash back for as little as $1 by visiting bmocashback.com. You can also setup recurring redemptions for as little as $25. You have the option to redeem your cash back right into your BMO chequing or savings account, or as a statement credit on your BMO CashBack World Elite Mastercard.

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, Social Insurance Number (SIN), address, employment status, income source(s), and rent or mortgage amount. The better picture we have of your financial health, the faster we can let you know if your application has been approved.

There are a few requirements you need to meet to apply for a credit card with us.

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps.

Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate.

If you have an emergency at home or away, you can contact the Mastercard Assistance Centre 24 hours a day: 1-800-247-4623 (within Canada and the U.S.) or 1-314-275-6690 (outside North America, call collect).

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 Canadian currency or more: