Overdraft protection

If you’re concerned your account may not have enough funds to cover upcoming expenses, overdraft protection can help you avoid the inconvenience of extra fees and declined transactions.

Ready to get started? Visit your branch to set up overdraft protection.

Select your overdraft protection

We offer two types of overdraft protection, so you can choose the type that suits your needs.

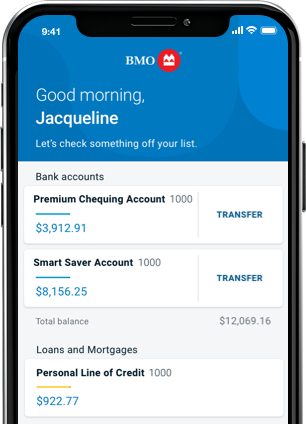

Standard Overdraft Protection: Find you’re frequently going into overdraft? No matter how often you do, this type is $5 a month. This fee is waived for Premium Chequing account customers*20.

Occasional Overdraft Protection (Not available for residents of Quebec): Get protection for occasional overdrafts. Forget the monthly fee, and instead pay $5 for each business day you create or increase the overdraft balance*21 or waive the fee if you have a Premium Chequing account.

Get more flexibility with our Overdraft Transfer Service

Arrange to have funds automatically transferred from your eligible BMO deposit accounts footnote 1, Mastercard footnote 2 or line of credit footnote 2 to cover overdraft amounts.

Pay just $5 per transfer*22.

Overdraft protectionFrequently Asked Questions

Overdraft protection is a simple way to cover for shortfalls in your account. It protects you against declined transactions, non-sufficient funds fees and returned cheques when your account is overdrawn.

You can apply for overdraft protection in any of our branches. Make an appointment to visit us.

Overdraft protection gives you access to additional funds, subject to credit approval, to cover your account when it’s overdrawn. You’ll be charged interest for the amount of overdraft protection you use, so it’s a good idea to pay off that loan as soon as you can.

If that’s not possible, you must make a deposit into your overdrawn account every 30 days and must not carry a negative balance for more than 90 consecutive days. You need to maintain a $0 or positive balance for at least one business day before dipping into the overdraft protection limit again.

We can let you know when your account balances are low. Customize your low-balance alerts in BMO Online Banking to stay up to date with your accounts.

Overdraft protection is meant as a short-term solution to cover unexpected shortfalls. If you find yourself consistently going into overdraft, you may want to consider other solutions, like a line of credit or a personal loan.

The interest rate is available online at bmo.com/rates. Interest will be calculated on your daily balance and charged to your account on the last business day of the month – explore the terms and conditions for your overdraft protection type.

Yes. Just make an appointment to visit a branch, and we can change your overdraft protection type.

Overdraft Transfer Service FAQs

The Overdraft Transfer Service allows you to cover an overdrawn balance by having funds automatically transferred to your BMO chequing account from an eligible BMO deposit account footnote 1, Mastercard footnote 2 or line of credit footnote 2 to cover any accidental overdraft.

Overdraft Transfer Service Overdraft protection You can use your own funds to cover the overdrawn balance using one of your companion accounts.

The bank gives you access to additional funds (subject to credit approval) to cover your overdrawn balance.

No interest footnote 3 is charged on the overdrawn amount. Daily interest footnote 5 is charged on the overdrawn amount until covered. A fee of $5 is charged at the time of the transfer footnote 4. A fee is charged based on your overdraft protection type. You need to have an eligible companion account (deposit account footnote 1, Mastercard footnote 2 or line of credit footnote 2) to set up this service. No need for a companion account. Doesn’t require a credit bureau check for eligibility. Credit bureau check is required to determine your eligibility for the product. Cover an overdrawn balance by having funds automatically transferred to your chequing account from your eligible BMO product, such as a:

- Deposit account footnote 1

- Mastercard footnote 2

- Line of credit footnote 2

Book an appointment at a branch or contact customer care at 1-877-225-5266.

There is a $5 fee charged per transfer. Funds are transferred the next business day and the fee is charged when the transfer is completed. Note: The Overdraft Transfer Service fee is waived if you have selected the Premium Plan and for customers with the Student and Recent Graduate or Seniors Discounted Banking.

The Overdraft Transfer Service allows you to link up to two eligible companion accounts to your BMO chequing account with Overdraft Transfer Service added. If the primary account does not have enough funds to cover the overdraft, the transfer will occur from the secondary account (if provided in the initial setup).

Why does my account appear overdrawn while using the Overdraft Transfer Service?

Case 1: If your initial setup is to bring the account balance to zero, the funds are transferred to cover the overdrawn amount by the following business day. The amount will appear overdrawn until a successful transfer takes place.

Case 2: If your initial setup is to bring the account balance within your overdraft protection limit and the overdrawn amount is more than your limit, the funds are transferred to bring the overdrawn amount within its overdraft protection limit by the following business day. Your account will appear overdrawn to your overdraft protection limit after the successful transfer takes place.

Can overdraft protection and Overdraft Transfer Service be used at the same time?

Yes. You can use both the services at the same time if the customer is eligible and approved for overdraft protection. The Overdraft Transfer Service will cover the entire overdrawn amount, or bring the overdraft within a pre-authorized limit, depending on the initial setup.

If I cover my overdrawn account before the end of the day, will I still get charged the overdraft fee?

No fee will be charged if you cover the overdrawn account by midnight (local time).

What happens if the linked account doesn’t have sufficient funds for the transfer?

If your linked companion account(s) does not have enough available funds to cover the overdrawn amount, we either authorize and overdraw your account (an overdraft per-item charge may be applied) or decline and return the non-sufficient funds item without payment (a returned item) and charge the non-sufficient funds fee without notice to you.